Table of Contents

Overview

Clorox agreed to acquire GOJO Industries, the maker of PURELL, for approximately $2.25 billion in cash, or about $1.9 billion after expected tax benefits. On paper, the price reflects a mature hygiene brand in a post-pandemic world.

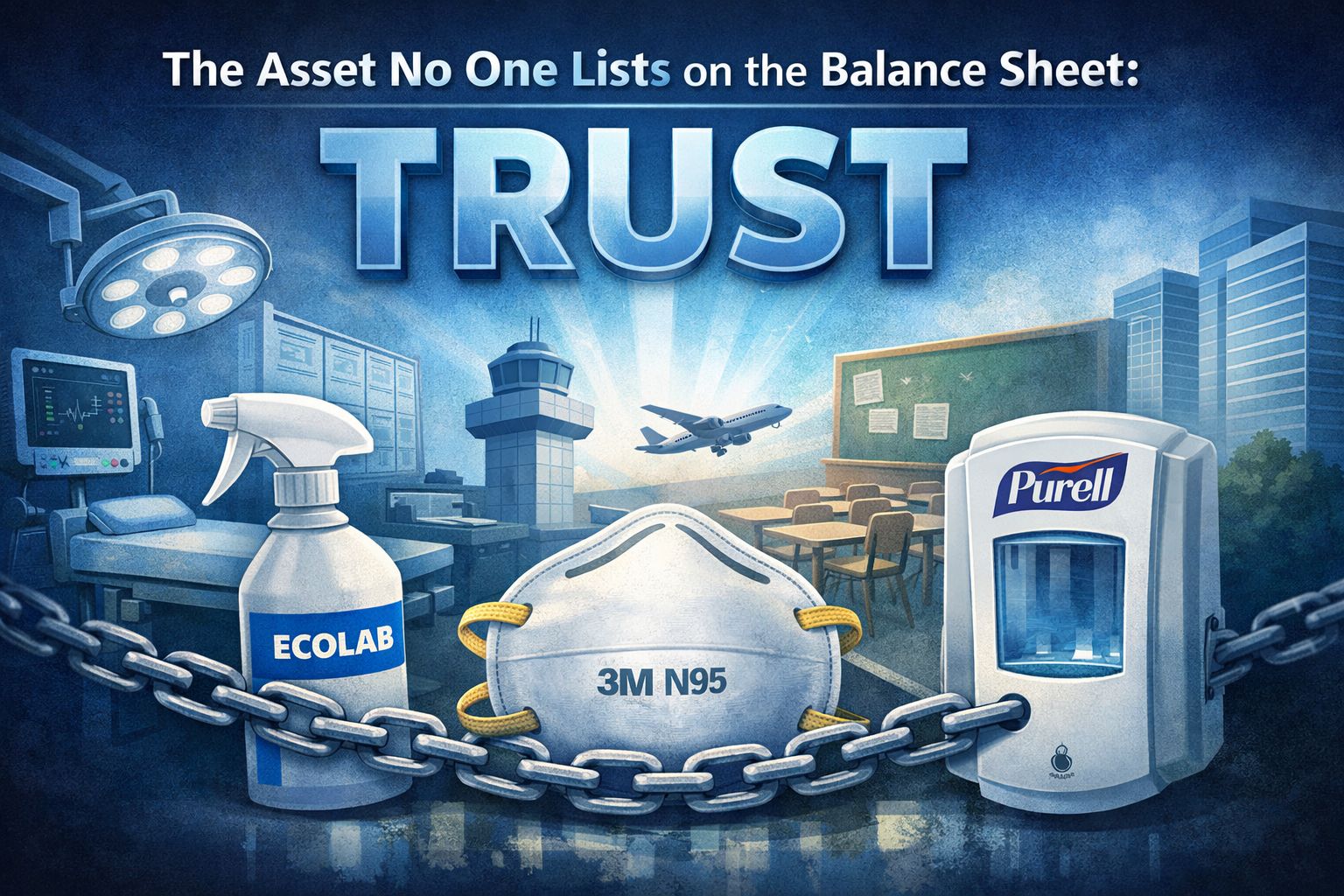

Clorox didn’t acquire PURELL because hand sanitizer is exciting. It acquired it because in regulated environments, trust behaves like infrastructure.

Hospitals, schools, airports, and corporate campuses don’t shop for hygiene the way consumers do. These decisions are governed by protocols, approvals, training, and liability. Once a product becomes the default, replacing it is no longer a purchasing decision — it’s a risk decision.

PURELL didn’t win because it marketed better. It won because it became acceptable to the people responsible for compliance. That acceptance compounds quietly over time until it becomes dominance.

This is the kind of asset that rarely shows up cleanly in a data room — but strategic buyers know exactly how valuable it is.

Where We’ve Seen This Pattern Prove Out

This acquisition follows a familiar pattern in industries where failure carries consequences.

Ecolab — Switching Is the Risk

Ecolab dominates sanitation in restaurants, food processing plants, and healthcare. Its products are not flashy. What they offer instead is consistency that has already been approved, documented, and trained against.

Switching sanitation providers means retraining staff, rewriting procedures, and risking inspection failures. Over time, Ecolab didn’t just sell chemicals — it embedded itself into operations.

The moat wasn’t innovation. It was the cost of uncertainty.

3M — Approval Beats Novelty

During COVID, dozens of new PPE brands flooded the market. Yet hospitals and government agencies overwhelmingly defaulted to 3M respirators whenever possible.

Even in a crisis, buyers avoided experimentation. Certifications, procurement history, and institutional trust mattered more than speed or price.

When risk rises, institutions don’t explore — they retreat to what’s already approved.

Cintas — Compliance as a Subscription

Cintas supplies uniforms, restroom products, and safety equipment to businesses that could source these items themselves. Companies stay not because Cintas is cheapest, but because it removes compliance friction.

Once compliance is outsourced, the provider becomes hard to displace. PURELL’s wall-mounted dispensers function the same way. They don’t just dispense sanitizer — they signal compliance without requiring thought.

Why This Matters for the Clorox–PURELL Deal

Clorox didn’t buy a consumer brand. It bought a position inside environments where experimentation is discouraged and defaults endure.

PURELL is less about scent, packaging, or shelf space — and more about risk management. In regulated settings, trust compounds faster than innovation. Once embedded, it becomes extraordinarily difficult to replace.

For operators and owners, the lesson is blunt:

The most valuable businesses aren’t always the fastest-growing. They’re the ones buyers are afraid to change.

The Takeaway

Acquisitions like this don’t happen because a product is popular. They happen because a business has positioned itself inside environments where replacement feels unnecessary — or unsafe.

PURELL’s value wasn’t created in marketing campaigns. It was created through acceptance, repetition, and institutional comfort. Clorox recognized that what looks ordinary on the surface can be structurally valuable underneath.

For owners building with an eventual exit in mind, the lesson is clear:

Build something your customers rely on without thinking — and buyers will notice.

What I Read So You Don’t Have To

Institutional buyers prioritize continuity over cost. Procurement decisions in regulated environments favor suppliers already aligned with approvals, documentation, and training standards.

Post-pandemic hygiene demand normalized, not disappeared. Emergency spikes faded, but baseline usage remained structurally higher in healthcare, education, and public facilities.

Strategic M&A has turned defensive. Buyers are targeting predictable demand and operational embedment rather than trend-driven growth stories.

Resources

Disclaimer: Some of the links below may be affiliate links*

Tools & Platforms You May Find Useful:

Kumo – AI-powered deal sourcing and CRM tailored for M&A professionals

BizBuySell – The largest online marketplace for buying and selling small businesses

Acquire.com – Streamlined platform to buy and sell startups and small businesses

MeetAlfred.com – LinkedIn and multichannel outreach automation

Outscraper – Web scraping tools for local business data, Google Maps, and more

CloudTalk.io - Power through calls faster with a flexible dialer built for growth teams. From AI support to advanced call routing, it helps you connect, convert, and scale. Get 50% using this link!

eVirtual Assistants - Hire a VA from the Philippines

Hostinger - Affordable, fast, and beginner-friendly web hosting with a built-in AI website builder to launch your site in minutes.

Beehiiv – A newsletter publishing platform built by newsletter creators

Enjoyed This Issue?

If you found these insights valuable, chances are someone in your network will too. Forward this email or share the article with a fellow business owner, strategist, or investor who needs to see what’s coming next.

The view is always better when more people are watching from the tower.