Table of Contents

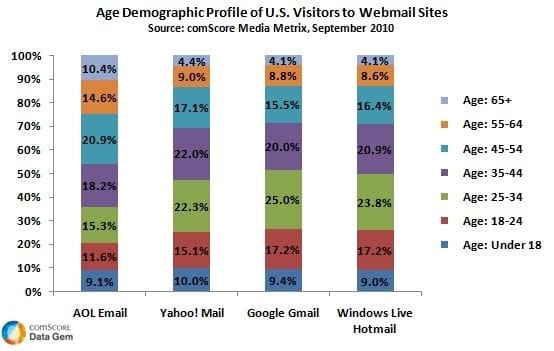

Most see AOL as a relic. Bending Spoons sees an annuity: an older, sticky audience that opens the same inbox every day. With roughly 8 million daily and 30 million monthly active users, AOL still ranks among the world’s top email providers—enough predictable behavior to justify the price tag and a plan to raise unit economics without breaking the routine.

Not more users, but more value per user

In a CNBC interview, CEO Luca Ferrari said the goal is to “unlock the potential” of AOL and emphasized it remains a “top email product.” Read that as a promise to monetize a habit they already own rather than chase growth at any cost. The work is threefold:

1) ARPU lift through trust bundles.

AOL’s cohort over-indexes for people who value reliability and human help. That maps cleanly to add-ons like identity protection, password vaults, enhanced scam filtering, cloud storage, and live support—the kinds of utilities that convert best at the exact fear moments inside mail: suspicious attachments, new device logins, and password resets.

2) Yield per session, not more sessions.

You do not need more pageviews to make the P&L work; you need better yield on existing behavior. That means fewer, higher-quality ad placements, first-party signals that actually improve targeting, and carefully placed house units that promote the paid bundle. If the surface gets cleaner and safer, ad pricing and conversion can move together.

3) Cost to serve down, reliability up.

Email is infrastructure. Margins expand when deliverability improves, spam complaints fall, and support tickets drop. Expect heavy investment in authentication and filtering, pruning of legacy cruft, and a concierge path for paying users. Debt on the deal forces discipline: opex per MAU must fall while NPS and inbox placement rise.

Why Bending Spoons might pull it off.

Their portfolio runs on subscription math and lifecycle marketing. Pricing experiments, upgrade nudges at the right moment, and tiered SLAs are exactly what a high-retention inbox needs. They do not have to fix AOL’s brand. They have to re-price the trust it already earns.

Old Brands, New Multiples

AOL shows that dated does not mean discounted. In mature markets, a sticky, high-frequency habit can be more valuable than shiny features. When an acquirer refreshes the surface, hardens security, and layers simple paid utilities on top, an older brand becomes a cash engine again. Owners who feel behind the tech curve can still command strong multiples if they can prove three things: users return on their own, churn stays low even with price moves, and the product controls a trust moment where buyers will pay for certainty. Keep the habit, modernize the rails, and package upgrades that remove risk. That turns legacy into leverage.

Old rails, new bundles

Email is still the internet’s identity layer: the login, the recovery address, the notification hub. Owning a top-tier provider lets you sell identity-adjacent utilities at scale. Meanwhile, legacy portals that survived did it by getting choosier with ads and bundling first-party tools where better ads beat more ads. As Bending Spoons stitches AOL into a portfolio that includes productivity and media assets, the shared muscle is subscription pricing, lifecycle messaging, and cost discipline.

In mature markets, the margin lives in reducing risk

AOL’s value is not nostalgia. It is a reliable, high-frequency surface where users feel vulnerable a few times a month. If you own that surface, you can sell certainty: we keep you safe, recover your account fast, and store your stuff. That is not a growth hack. It is a cash-flow model built on trust, habit, and careful product restraint.

What I Read So You Don’t Have To

MacMillan Acquisiton: Macmillan acquires Sounds True’s book, e-book, audiobook, and audio-original catalogs; books and e-books move to St. Martin’s Essentials; audio consolidates under Macmillan Audio; Tami Simon focuses on direct-to-consumer learning and events.

Audio Publishers Association Sales Survey (2024): U.S. audiobook revenue reached $2.22B in 2024 (+13% YoY), with digital at 99% of sales. Format growth supports consolidating audiobook and audio-original rights under one owner.

Resources

Drowning in Details? Here’s Your Life Raft.

Stop doing it all. Start leading again. BELAY has helped thousands of leaders delegate the details and get back to what matters most.

Access the next phase of growth with BELAY’s resource Delegate to Elevate.

Disclaimer: Some of the links below may be affiliate links*

Sources & Further Reading:

Tools & Platforms You May Find Useful:

Kumo – AI-powered deal sourcing and CRM tailored for M&A professionals

BizBuySell – The largest online marketplace for buying and selling small businesses

Acquire.com – Streamlined platform to buy and sell startups and small businesses

MeetAlfred.com – LinkedIn and multichannel outreach automation

Outscraper – Web scraping tools for local business data, Google Maps, and more

Hoppy Copy - Turn ideas into ready-to-send emails, ads, and posts in minutes — faster copy, better results.

CloudTalk.io - Power through calls faster with a flexible dialer built for growth teams. From AI support to advanced call routing, it helps you connect, convert, and scale. Get 50% using this link!

Beehiiv – A newsletter publishing platform built by newsletter creators

Enjoyed This Issue?

If you found these insights valuable, chances are someone in your network will too. Forward this email or share the article with a fellow business owner, strategist, or investor who needs to see what’s coming next.

The view is always better when more people are watching from the tower.