Table of Contents

Most acquisitions make headlines for their price tag. This one made headlines for its subpoenas. Nielsen’s sale of its Marketing Mix Modeling (MMM) unit to Circana was supposed to be another quiet carve-out in the crowded analytics space. Instead, it turned into a Delaware courtroom drama over who controls the data that makes the business valuable.

And yet — after all the lawsuits, restraining orders, and expedited hearings — the deal still closed in August. With so many twists and turns, it’s no surprise that the total acquisition costs remain undisclosed.

The Court Battle

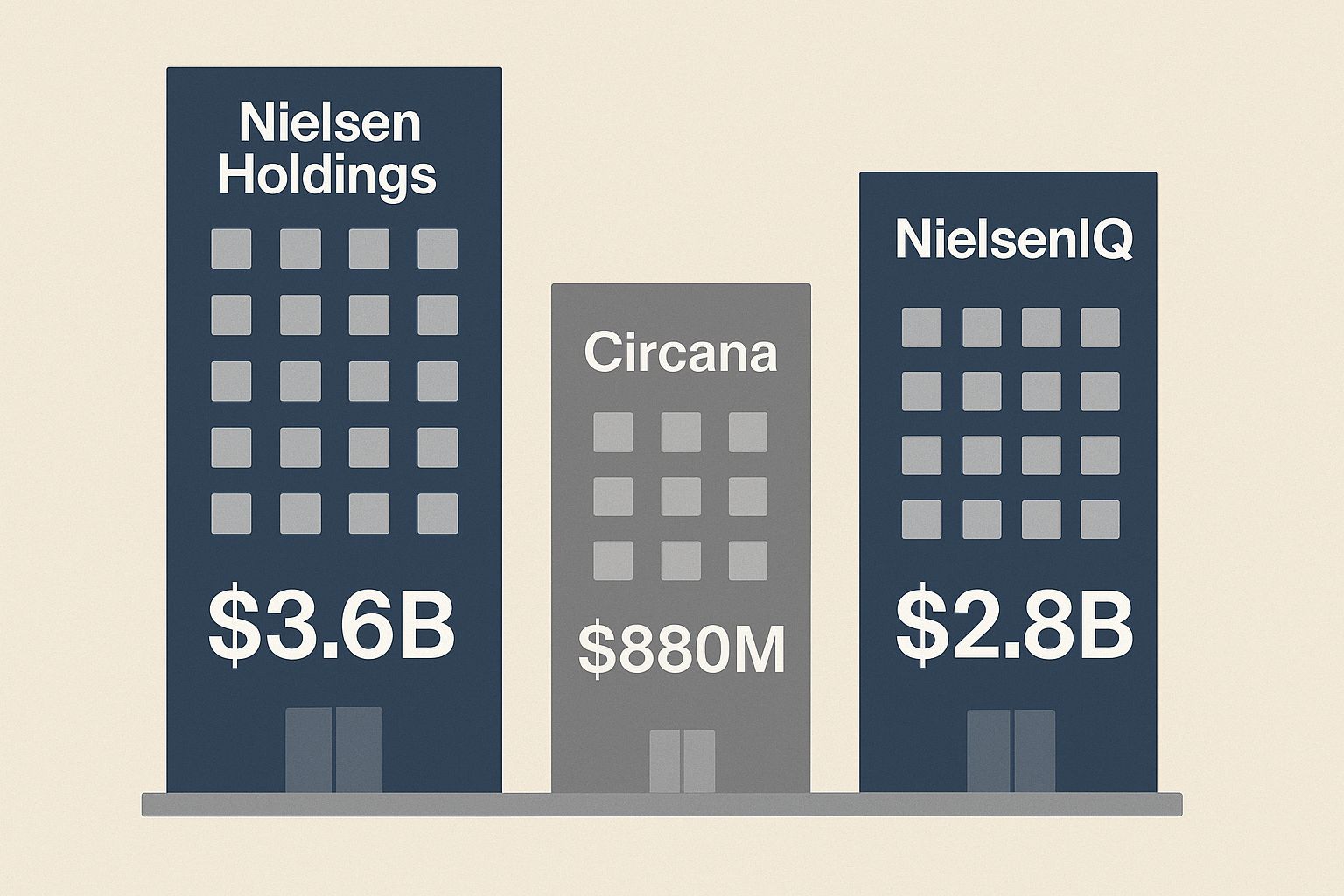

The heart of the fight wasn’t over the unit itself, but the data pipelines that power it. NielsenIQ (NIQ), the consumer-behavior firm spun out of Nielsen in 2021, moved to choke off access to consumer data just as the sale was heading to the finish line. Nielsen Holdings accused NIQ of sabotage, Circana feared it was being sold an empty shell, and the Delaware Chancery Court was dragged in to referee.

Vice Chancellor Nathan Cook issued a temporary restraining order to preserve Nielsen’s access to the data until the dispute could be fully tried. Circana’s access remained unresolved, but the pressure was enough to force the transaction forward.

By late August, Circana officially acquired Nielsen’s MMM business — but not without leaving observers to wonder whether this was a deal consummated by strategy or by sheer legal force. And given the courtroom wrangling, the absence of a disclosed purchase price speaks volumes: some deals are so fraught that even the dollar figure becomes a casualty of confidentiality.

Carve-outs

This saga shines a harsh light on the hidden dangers in mergers and acquisitions. Carve-outs in particular don’t just transfer people and products; they live or die by the continuity of data, systems, and access agreements. When rivals control critical pipes, even a signed contract can collapse without legal muscle.

It’s also a sign of where the analytics industry is headed. Consolidators like Circana are racing to build end-to-end measurement platforms, while incumbents like Nielsen are reshaping themselves through divestitures. But as data becomes the true currency, expect more battles where the courtroom, not the boardroom, decides whether value actually changes hands.

The Takeaway

The Nielsen–Circana deal is a reminder that selling a business isn’t just about finding a buyer. It’s about securing the invisible assets — access, rights, and relationships — that make the business worth buying in the first place.

For owners, the lesson is clear: in M&A, the paperwork is only half the story. The real test is whether the value you think you sold (or bought) is still there once the dust — and sometimes the subpoenas — settle.

What I Read So You Don’t Have To

Circana Completes Nielsen MMM Acquisition (Aug 2025) — Despite disputes, the deal closed, adding to Circana’s analytics arsenal.

Delaware TRO (June 2025) — Court stepped in to preserve Nielsen’s data access after NIQ allegedly tried to block the transaction.

NCSolutions Acquisition (June 2025) — Circana also acquired NCS, showing its aggressive push into media ROI analytics.

Global Data Regulation Pressure — Privacy laws are tightening worldwide, adding friction to how data moves between companies in deals.

Carve-Out Complexity — Analysts note that divesting business lines often triggers operational disputes over data, contracts, and customer continuity.

Resources

Disclaimer: Some of the links below may be affiliate links*

Sources & Further Reading:

Tools & Platforms You May Find Useful:

Kumo – AI-powered deal sourcing and CRM tailored for M&A professionals

BizBuySell – The largest online marketplace for buying and selling small businesses

Acquire.com – Streamlined platform to buy and sell startups and small businesses

MeetAlfred.com – LinkedIn and multichannel outreach automation

Outscraper – Web scraping tools for local business data, Google Maps, and more

GetCalley – Free auto-dialer for outbound calling and lead follow-up

Postale.io – Affordable custom domain email hosting

eVirtual Assistants - Hire a VA from the Philippines

Hostinger - Affordable, fast, and beginner-friendly web hosting with a built-in AI website builder to launch your site in minutes.

Beehiiv – A newsletter publishing platform built by newsletter creators

Enjoyed This Issue?

If you found these insights valuable, chances are someone in your network will too. Forward this email or share the article with a fellow business owner, strategist, or investor who needs to see what’s coming next.

The view is always better when more people are watching from the tower.